RTM 7

$995

Compatible Platform: OmniTrader / VisualTrader

Recommended Data: End Of Day / Real Time

RTM7 is a powerful Strategy that is based on the Reversion to Mean concept. Testing it on the S&P 100 list, the Strategy showed solid performance over 12 years, generating an average 23% return with an average draw-down of just 5%. Those are some impressive numbers— especially over such a long period of time and through some of the toughest markets we have seen.

The Path to RTM7

by Ed Downs

With over 20 years of experience, our scientists are very good at developing profi table Strategies. And usually, we try to maximize gains. But recent market events have made it clearer than ever before that MINIMIZING RISK is just as important as maximizing profi ts, if not more so.

“Our goal was to create a Strategy that can make steady gains in normal markets while staying protected against adverse market events.”

The markets have provided plenty of surprises over the past ten years. After 9/11, the markets went through an unprecedented sell-off. There was the Subprime Mortgage Meltdown of 2008. Then we saw a Flash Crash, followed by a Credit Downgrade that led to a 1,200 point drop on the Dow. None of these events were predictable.

Our goal was to create a Strategy that can make steady gains in normal markets while staying protected against the aforementioned adverse market events. This focus led to the creation of a new Strategy called RTM7, which is based on the Reversion to Mean (RTM) concept (see sidebar).

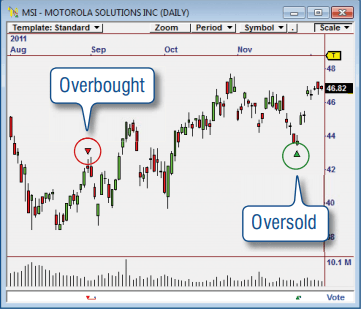

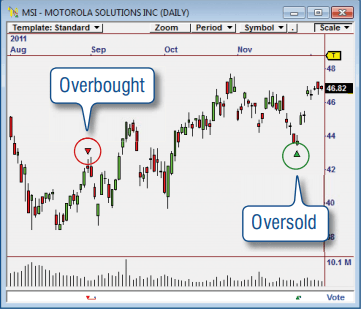

The RTM concept works because the psychology of markets around pull-backs is highly predictable. When markets get overbought, they are subject to small corrections; and when they get oversold, they are subject to “reactive” buying.

Because the RTM Strategy takes advantage of short term pricing disparities it is less affected by market events. Even with really bad news, like the Credit Downgrade of August 2011, RTM7 maintains its potential to steadily grow your trading account. The Path to RTM7 Welcome to High Probability, Low Risk Trading 2 Overbought Oversold 3 RTM7

A Powerful Concept

“Reversion to Mean is a mathematical concept used for stock investing, based on the assumption that a stock’s high and low prices are temporary and that price will tend to move back to the average price over time.”

–Wikipedia Finance

In markets that are steadily trending or moving sideways, stocks and ETFs will often become temporarily oversold, making them attractive for purchase. They also may be bid up, so as to invite profit taking or short selling.

The goal of an RTM Strategy is to identify these overbought and oversold points and make a quick profit from the disparity. The key is determining how much of a pull-back to look for. Then, good rules are required to fi re an Exit to capture profits, usually 2-3 price bars later.

With the right Entry and Exit rules, an accuracy of over 70% can be generated. This is in fact what we are seeing in our new RTM7 Strategy

Consistent

Profits with Low

Drawdowns

RTM7 is a powerful Strategy that is based on the Reversion to Mean concept. Testing it on the S&P 100 list, the Strategy showed solid performance over 12 years (see page 4), generating an average 23% return with an average drawdown of just 5%.

Those are some impressive numbers— especially over such a long period of time and through some of the toughest markets we have seen.

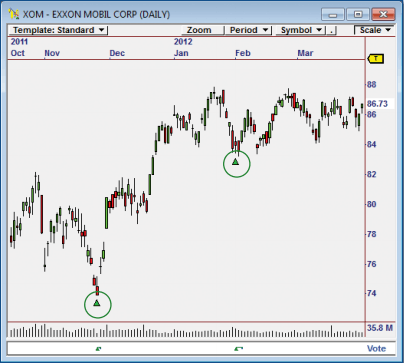

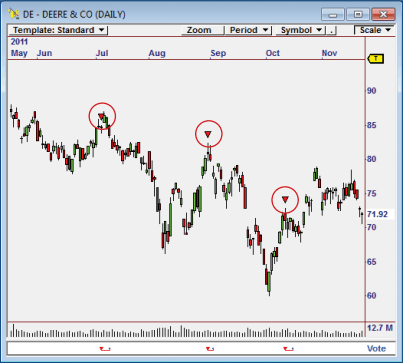

To the right are some typical trades identified by RTM7. Using proprietary indicators, the Strategy identifies unusual moves away from average price and looks to take a quick profit on the reversal. It also maintains relatively tight stops. It is this structure of the trades that keeps drawdowns low and steadily builds profits.

Powerful Short Trades

This is one of the first RTM Strategies we have developed that includes Short trades. We spent quite a bit of time working on the Entry Signal rules to avoid “false” Shorts.

This is important because most markets have a bullish bias, and it is easy to fi re Short Signals against a prevailing trend. We added special trend logic to detect these situations and avoid them.

The result is that the Short Signals fired by RTM7 are simply outstanding. They tend to fire at very clear reversal points to the downside. The inclusion of Short Trades ensures this Strategy performs well in bear markets.