MVX-15

$495

Compatible Platform: OmniTrader / VisualTrader

Recommended Data: End Of Day / Real Time

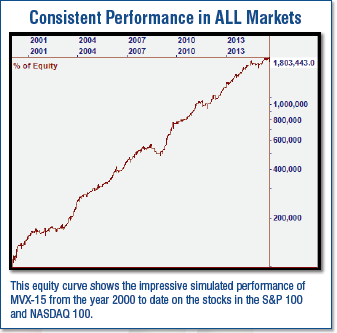

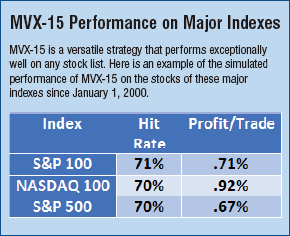

MVX-15 looks at volatility in different ways by using the new MVX Signal Filter. This updated version now uses the all new Expectancy Feature to drastically improve performance in the ALL NEW MVX-15 EXP strategy.

Taming a Volatile Market

The recent market has once again reminded us that various global events can have a major impact. When

uncertainty comes into play, the broad market can turn very volatile and this volatility can have a significant impact on our trading.

Our developers have recently been researching how we could reduce the impact of these uncertain markets. What

we found was that while some volatility helps RTM strategies, we can improve results in all market conditions by avoiding excessive volatility.

Taming a Volatile Market

The recent market has once again reminded us that various global events can have a major impact. When

uncertainty comes into play, the broad market can turn very volatile and this volatility can have a significant impact on our trading.

Our developers have recently been researching how we could reduce the impact of these uncertain markets. What

we found was that while some volatility helps RTM strategies, we can improve results in all market conditions by avoiding excessive volatility.

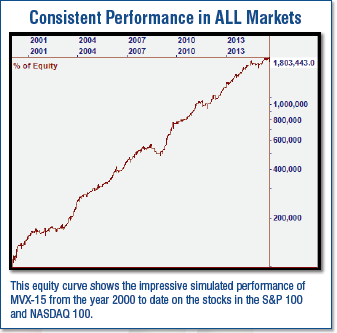

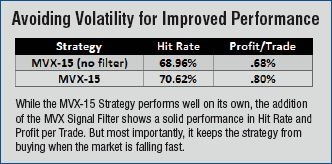

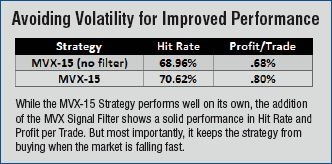

The MVX Signal Filter measures the day to movement of the VIX. When excessive movement is detected, the filter will not allow signals to pass. This process not only helps the performance of the new MVX-15 Strategy, but it also improves the profitability and accuracy of ANY Reversion to Mean Strategy

The Power of the MVX Signal Filter

The MVX Signal Filter doesn’t filter out many trades, but the trades that it does pass over typically occur in risky markets most of us would like to avoid.

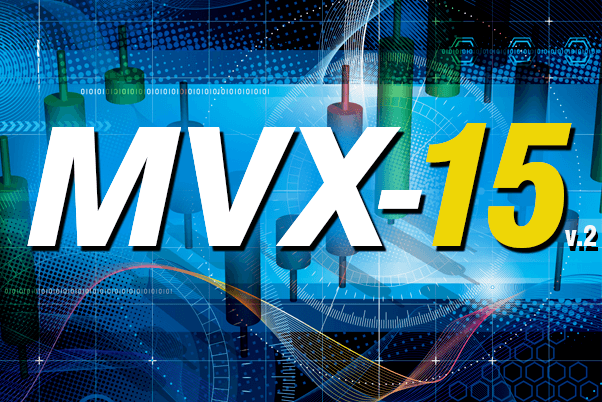

The illustration on the right shows an example of the performance

of MVX-15 with and without the MVX Signal Filter. Without the filter,

the strategy fired a signal on AMGN in an increasingly volatile market. The fear in the market continued to drive the stock down, resulting in a 9% loss.

However, with the MVX Signal Filter active, excessive volatility was

detected. This allowed the strategy to avoid the signal as well as the

resulting loss.

This filtering by MVX-15 doesn’t affect most of the signals, but in volatile markets it is essential to avoiding unnecessary risk.

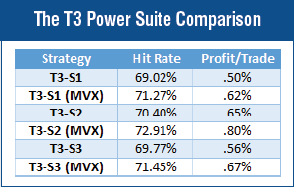

Improves EVERY RTM Trading Strategy!

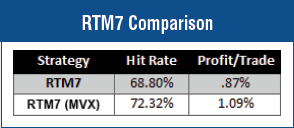

The MVX Signal Filter improves the performance of the base MVX Trading Strategy as shown earlier. But the real magic of this advanced technology is that the filter can improve the performance of ANY Reversion to Mean Strategy. MVX-15 owners can now get

upgraded versions of their previous RTM Strategies. Take a look at how this strategy improves any existing premier RTM Strategies*.

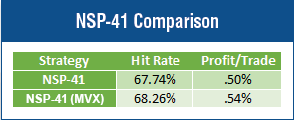

NSP-41 (MVX)

NSP-41 was our first RTM Strategy that was released in June of 2010. While the strategy has done remarkably well since release, by using the MVX Signal Filter it shows the ability to improve both accuracy and profitability.