Value vs. growth in 2021? AFP via Getty Images

Optimism is in the air for Tuesday, as the formal transition process for President-elect Joe Biden got the green light from the current White House administration, and former Federal Reserve chair Janet Yellen drew some Wall Street cheers as his Treasury secretary appointee.

Not everyone is enthusiastic about her, though: “Yellen’s long career arc from academic economics to economic adviser to presidents, then to Fed chief, and now to economic chief for a president, has not exactly overlapped with a concurrent period of relative American economic ascent — or at least not for the majority of its population,” said Michael Every, global strategist at Rabobank, to clients in a note.

Politics aside, Wall Street’s equity forecasts for 2021 are trickling in and some are painting a bullish picture, like JPMorgan’s forecast for the S&P 500 to hit 4,500 by end 2021, or Goldman Sachs’ end-year 4,600 target — 28% above Monday’s close of 3,577.

Our call of the day, from independent investment bank Stifel’s head of institutional equity strategy, Barry Bannister, says Wall Street may be getting a little too optimistic over how high the index can go, as the world digs out of the COVID-19 pandemic.

“Near-term risks include slower growth (delayed fiscal) and a flatter yield curve, cuts to 2021 EPS [earnings per share] consensus and the disruptive effects in 2021 if the dollar does indeed weaken,” Bannister told clients in a note. A flattening yield curve can indicate economic uncertainty.

Bannister said the team’s S&P 500 EPS estimate is 10% below Wall Street’s, and if that consensus comes down, growth stocks tend to swing into favor.

“Despite enthusiasm for a value vs. growth cycle, the characteristics of that shift may be a case of ‘be careful what you wish for’ as populism, currency debasement, a greater Federal role in GDP [gross domestic product] and the long march toward a geopolitical conflict is the norm,” said the Stifel manager.

Part of Wall Street’s optimism is wrapped up in a broad-based rally for both growth and value stocks. The latter group, unloved for years, has recently been getting some investor love amid hopes the economy could be turning higher.

What Bannister is expecting is the so-called reflation trade, the idea that stronger growth and inflation will benefit those value or cyclical stocks, won’t last. Hence that rotation may stop dead in its tracks.

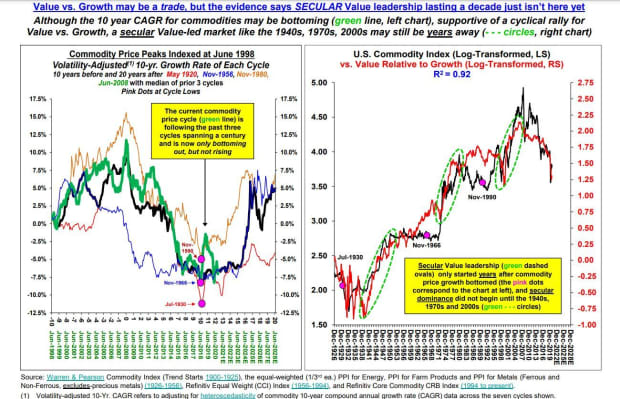

And Bannister also pours cold water on the idea that investors are seeing the start of a secular rotation, which tends to last a decade or more, into those value stocks and away from their growth rivals.

Critical to the argument for investing in value stocks is the bottoming of commodity prices, which is just starting to happen, the team said. Secular value leadership has in the past started “years” after commodity prices bottom, the team noted, so investors may be waiting that long for another one to start, it said.

The markets

Stock futures

ES00,

+0.71%

NQ00,

+0.31%

are higher, led by those for the Dow industrials

YM00,

+0.96%,

with European stocks also gaining and Asian markets also high. That is as the dollar

DXY,

-0.18%

and gold

GC00,

-1.56%

pull back.

The chart

The Russell 2000 index

RUT,

+1.84%

of small-cap companies continues to strengthen as investors move into stocks that are a play on an economic recovery as COVID-19 vaccine news pours in. That move has only just begun, say some:

Read: ‘Goldilocks’ funds? Midcap ETFs may be about to have their moment

The buzz

In the retail sector, Best Buy

BBY,

+2.43%,

Abercrombie

ANF,

+8.61%,

Dick’s Sporting Goods

DKS,

+0.51%

and Dollar Tree

DLTR,

+2.78%

will report results early, along with food groups Hormel

HRL,

-0.19%

and Smucker

SJM,

-0.15%.

Earnings from personal computer makers Dell

DELL,

+1.52%

and HPQ

HPQ,

+3.61%

are expected after the close.

Elon Musk, the head of electronic-car company Tesla

TSLA,

+6.58%,

is now the second-richest person in the world.

While U.S. health-care workers and officials brace for Thanksgiving related infections, with two million people passing through airports last weekend, in the U.K. and France, plans are afoot for some easing of restrictions in time for Christmas.

Financial aid could help ease anti-mask attitudes, says Dr. Celine Gounder, Biden’s coronavirus adviser. And the International Air Transport Association says it has created a digital travel pass to provide COVID credentials at airports.

Chess is hot. A record 62 million households watched “The Queen’s Gambit” in the first 28 days, says streaming video giant Netflix

NFLX,

-2.38%.

Case-Shiller home prices and a consumer confidence index are ahead.

Random reads

Evidence of extraterrestrials or artists in the Utah desert?

Cambridge University Library learns that priceless notebooks from 19th-century scientist Charles Darwin have been missing for 20 years.