OptionTrader 6

Buy for $995.00 or Subscribe for $99/mo

Compatible: OmniTrader / VisualTrader

Best Data Feed: OmniData Real Time

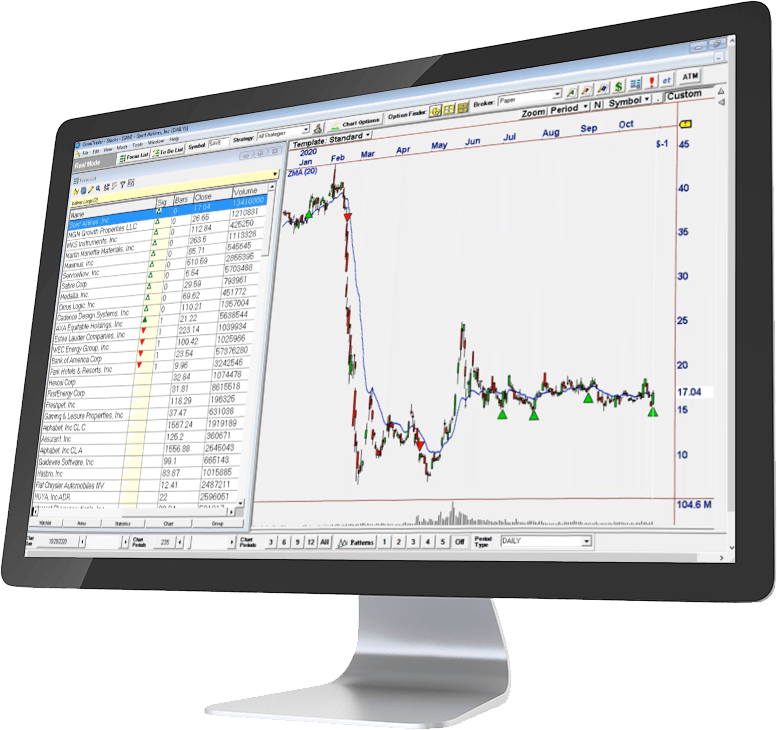

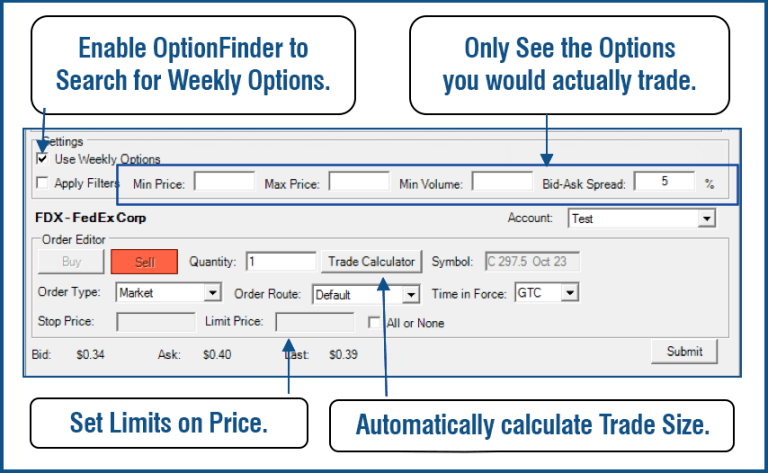

OptionTrader 6 has a few simple controls that enable YOU to limit your option selection to ONLY those you would actually trade. Avoid getting “killed” on the Bid-Ask spread. Avoid trading options with too little volume. Or options that cost a few cents. You ONLY see the ones that you would actually trade.

Why Trade Options?

Unlimited Gains – with Limited Risk

More and more investors are discovering how profitable Options can be. The advantages of trading options are:

Limited Risk – You can only lose the option premium.

Unlimited Gains – A Call or Put can continue to make money to expiration.

Leverage – Control 100 shares of a stock like Apple (price $115) for $600 instead of $11,500.

No Need to Short! – Make money on stocks going down by purchasing Puts.

And More (income, protection, etc. with more advanced strategies).

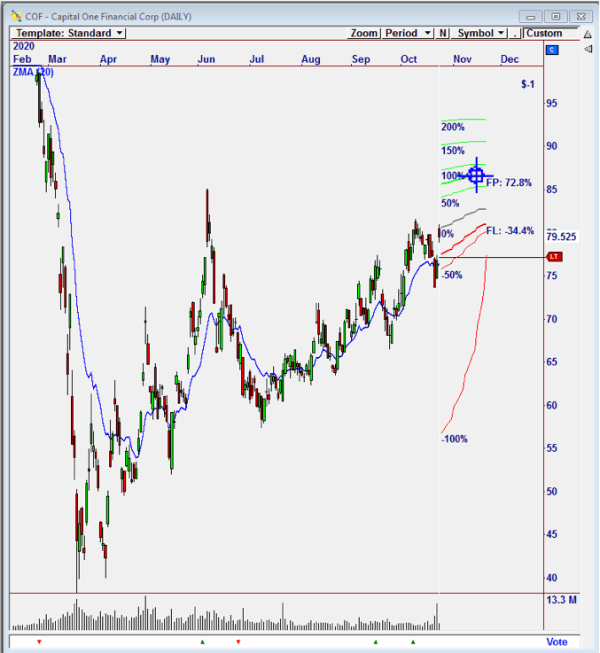

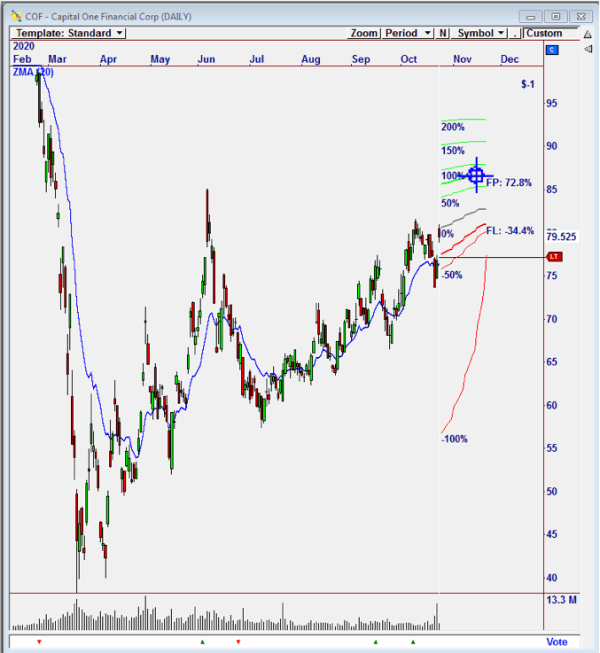

To the right is an option trade that shows the profit potential of Call Purchases.

Capital One looks bullish. We can buy the Nov $77.5 Call expiring in 3 months for just $5.50. If the stock goes to $88 we double our money.

Why Trade Options?

Unlimited Gains – with Limited Risk

More and more investors are discovering how profitable Options can be. The advantages of trading options are:

▲ Limited Risk – You can only lose the option premium.

▲ Unlimited Gains – A Call or Put can continue to make money to expiration.

▲ Leverage – Control 100 shares of a stock like Apple (price $115) for $600 instead of $11,500.

▲ No Need to Short! – Make money on stocks going down by purchasing Puts.

▲ And More (income, protection, etc. with more advanced strategies).

To the right is an option trade that shows the profit potential of Call Purchases.

Capital One looks bullish. We can buy the Nov $77.5 Call expiring in 3 months for just $5.50. If the stock goes to $88 we double our money.

It’s Incredible What This Thing Does.

Order Entry Simplified

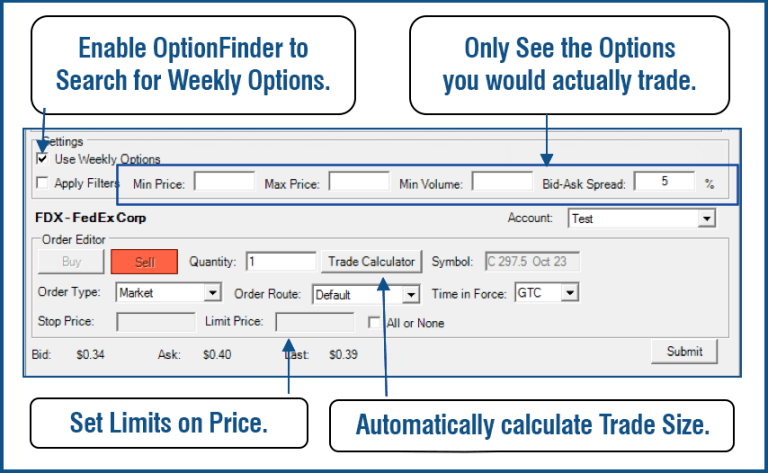

Ready to buy? Set a LIMIT price so the Market Makers on the Option Floor won’t take advantage of you. If the option is BID: 1.50 and ASK: 1.60 you could set your LIMIT at $1.55, for example.

And, you can automatically trade a set dollar amount, contracts, or percent of your account. It’s all automated with the Trade Calculator.

It’s Incredible What This Thing Does.

Order Entry Simplified

Ready to buy? Set a LIMIT price so the Market Makers on the Option Floor won’t take advantage of you. If the option is BID: 1.50 and ASK: 1.60 you could set your LIMIT at $1.55, for example.

And, you can automatically trade a set dollar amount, contracts, or percent of your account. It’s all automated with the Trade Calculator.

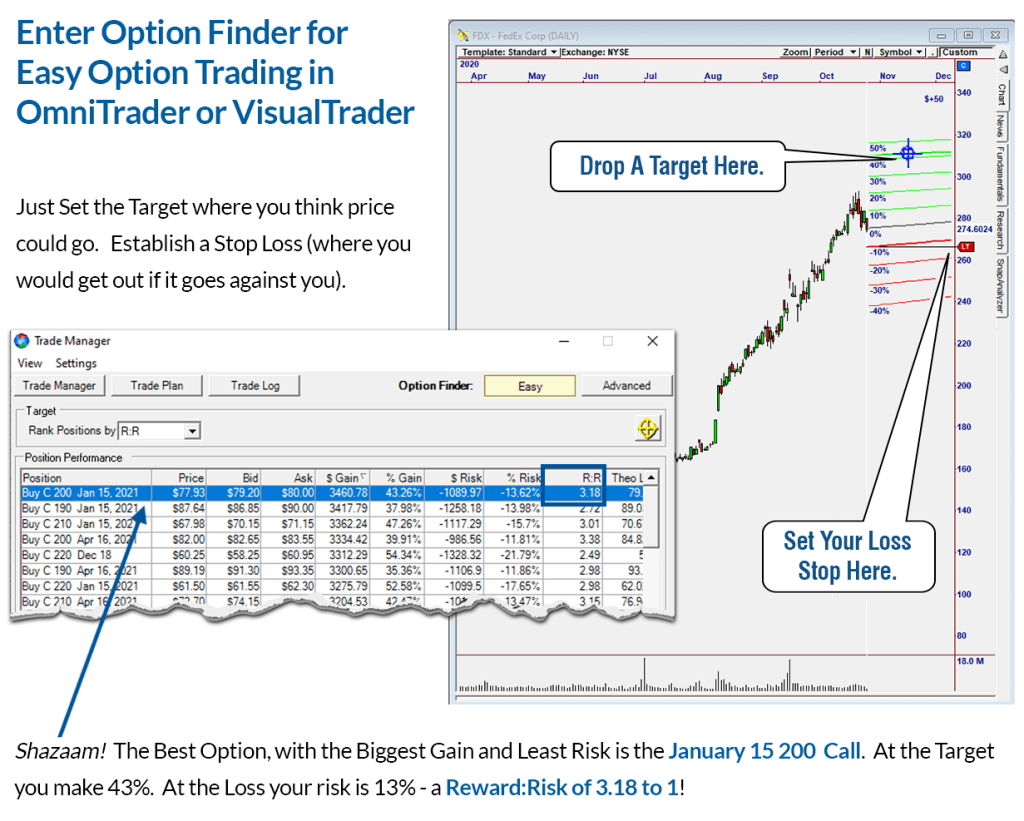

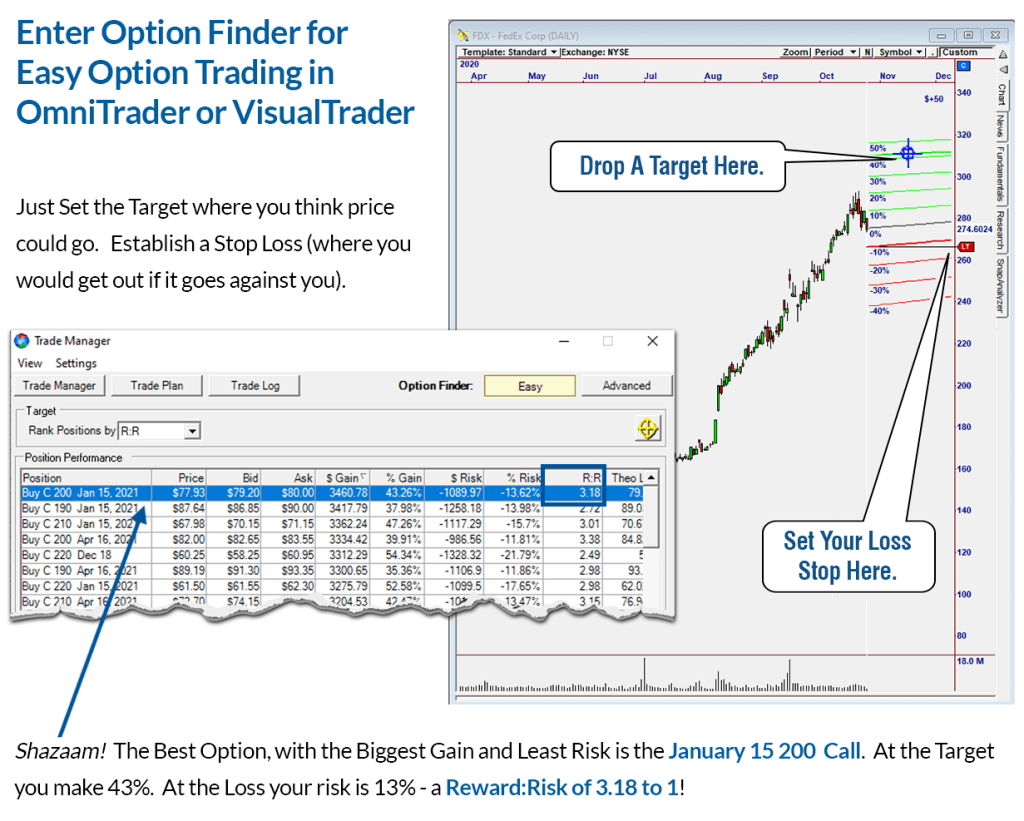

New EASY Mode!

Here's How It Works:

Easy Mode Makes it super easy to find the RIGHT Calls & Puts to trade, on any chart, for highest gains with least risk.

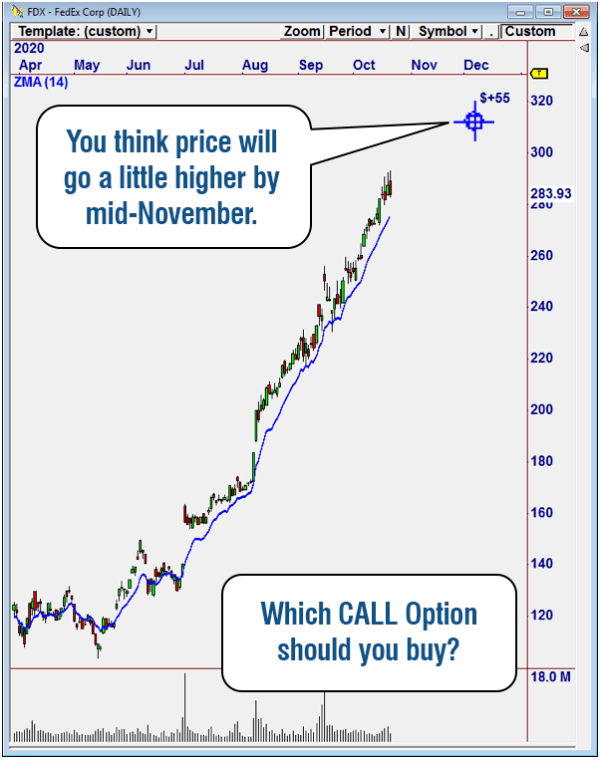

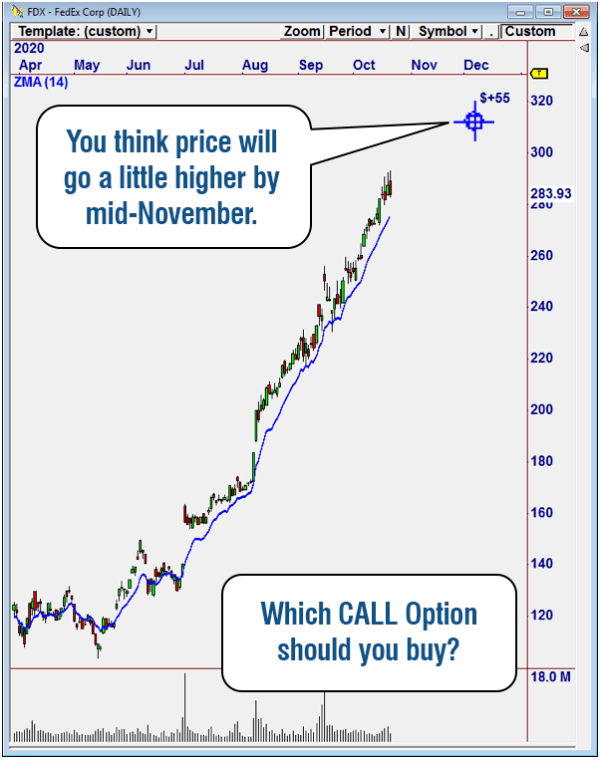

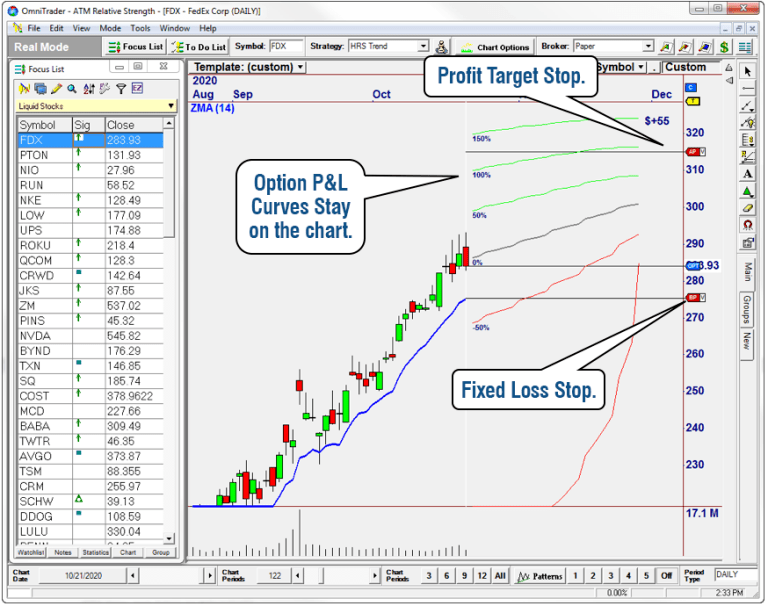

Fedex has been on a tear, more than doubling over 6 months. Let’s say you believe it’s going to go up a modest amount more by the middle of November, and you want to buy a Call.

Now, you have to figure out...

Which Call Option should I Buy?

How much will I have to Invest?

If I set a Stop Loss, how much can I lose?

What is my “Risk to Reward”?

To the right is an option trade that shows the profit potential of Call Purchases.

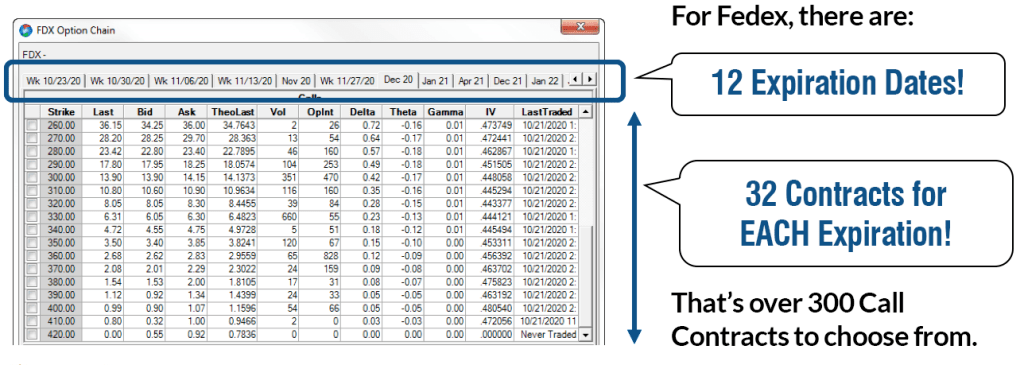

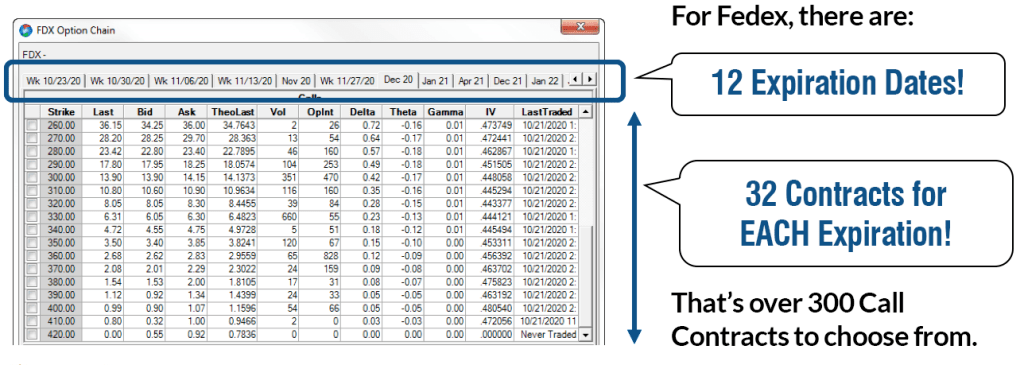

The option chain for FDX looks like this:

?

“How can us Non-Geeks navigate the sea of Strikes, Dates, Implied

Volatilities, Greeks and all the rest of it?” Seems impossible, right?

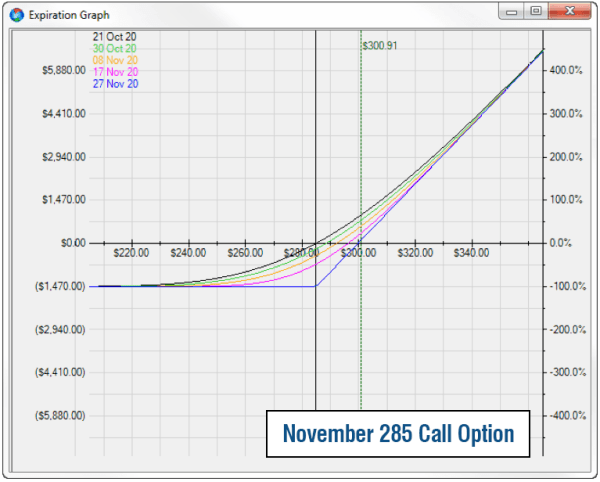

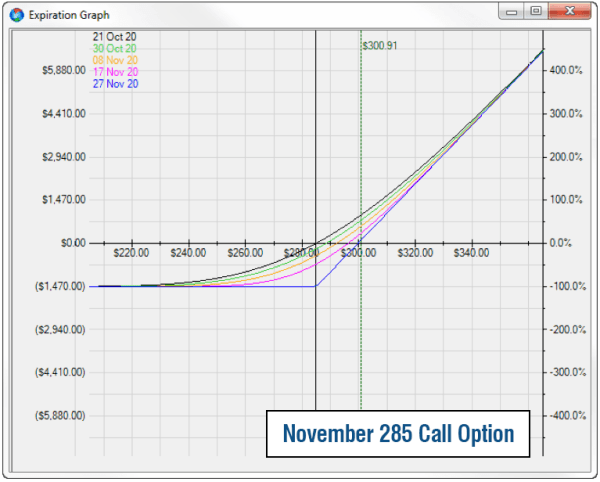

Most people teach options with “Expiration Curves” like the one shown here for the November 285 Call on Fedex (FDX). Does this help YOU decide whether to buy that Call or not?

!

No way! It Has to Be Easier Than This...

New EASY Mode!

Here's How It Works:

Easy Mode Makes it super easy to find the RIGHT Calls & Puts to trade, on any chart, for highest gains with least risk.

Fedex has been on a tear, more than doubling over 6 months. Let’s say you believe it’s going to go up a modest amount more by the middle of November, and you want to buy a Call.

Now, you have to figure out...

▲ Which Call Option should I Buy?

▲ How much will I have to Invest?

▲ If I set a Stop Loss, how much can I lose?

▲ What is my “Risk to Reward”?

To the right is an option trade that shows the profit potential of Call Purchases.

The option chain for FDX looks like this:

?

“How can us Non-Geeks navigate the sea of Strikes, Dates, Implied

Volatilities, Greeks and all the rest of it?” Seems impossible, right?

Most people teach options with “Expiration Curves” like the one shown here for the November 285 Call on Fedex (FDX). Does this help YOU decide whether to buy that Call or not?

!

No way! It Has to Be Easier Than This...

Start EASY, then Graduate to ADVANCED!

This is the most powerful option trading software ever invented. Once you get comfortable using Easy Mode, you will be ready to trade even more powerful Strategies.

Depending on the market situation, the Profit/Loss characteristics of some Option Methods like “Debit Spreads” and “Diagonal Spreads” are superior to just buying Calls or Puts. ADVANCED operates just like EASY Mode– Place a Target and get a list of ranked trades, except you will have many different Option Methods to choose from.

Click here to learn more about ADVANCED MODE!

Start EASY, then Graduate to ADVANCED!

This is the most powerful option trading software ever invented. Once you get comfortable using Easy Mode, you will be ready to trade even more powerful Strategies.

Depending on the market situation, the Profit/Loss characteristics of some Option Methods like “Debit Spreads” and “Diagonal Spreads” are superior to just buying Calls or Puts. ADVANCED operates just like EASY Mode– Place a Target and get a list of ranked trades, except you will have many different Option Methods to choose from.

Click here to learn more about ADVANCED MODE!

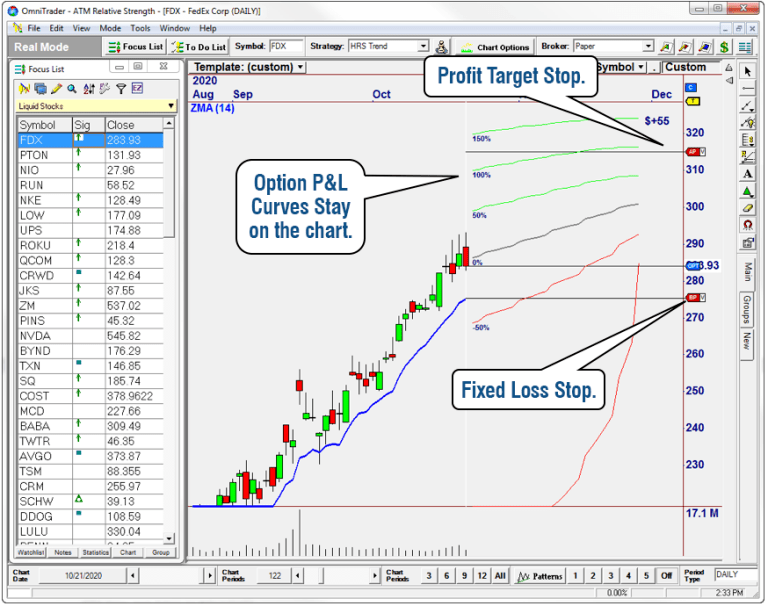

Yes. It’s Integrated -

Exclusively for OmniTrader and VisualTrader users.

In either platform, just put the Target in the Chart, select your option and trade.

Then, add Profit Targets or Loss Stops right in the chart, and easily manage your trade day to day with the built-in portfolio.

The Option Profit/Loss Curves will remain in the chart, and will adjust as volatility in the underlier changes.

Doesn’t that beat Expiration Curves? Heck yeah!

Yes. It’s Integrated -

Exclusively for OmniTrader and VisualTrader users.

In either platform, just put the Target in the Chart, select your option and trade.

Then, add Profit Targets or Loss Stops right in the chart, and easily manage your trade day to day with the built-in portfolio.

The Option Profit/Loss Curves will remain in the chart, and will adjust as volatility in the underlier changes

Doesn’t that beat Expiration Curves? Heck yeah!

Version History

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

Ut enim ad minim veniam, quis nostrud exercitation.

Duis aute irure dolor in reprehenderit in voluptate velit esse.

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

Ut enim ad minim veniam, quis nostrud exercitation.

Version History

▲ Lorem ipsum dolor sit amet, consectetur adipiscing elit.

▲ Ut enim ad minim veniam, quis nostrud exercitation.

▲ Duis aute irure dolor in reprehenderit in voluptate velit esse.

▲ Lorem ipsum dolor sit amet, consectetur adipiscing elit.

▲ Ut enim ad minim veniam, quis nostrud exercitation.

OptionTrader 6

Buy for $995.00 or Subscribe for $99/mo

Compatible: OmniTrader / VisualTrader

Best Data Feed: OmniData Real Time

OptionTrader 6

Buy for $995.00 or Subscribe for $99/mo

Compatible: OmniTrader / VisualTrader

Best Data Feed: OmniData Real Time

Important Information: Futures, options and securities trading has risk of loss and may not be suitable for all persons. No Strategy can guarantee profits or freedom from loss. Past results are not necessarily indicative of future results. These results are based on simulated or hypothetical performance results that have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. There are numerous market factors, including liquidity, which cannot be fully accounted for in the preparation of hypothetical performance results all of which can adversely affect actual trading results. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.

Important Information: Futures, options and securities trading has risk of loss and may not be suitable for all persons. No Strategy can guarantee profits or freedom from loss. Past results are not necessarily indicative of future results. These results are based on simulated or hypothetical performance results that have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. There are numerous market factors, including liquidity, which cannot be fully accounted for in the preparation of hypothetical performance results all of which can adversely affect actual trading results. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.