ARM Technolody

- OVERVIEW

- ARM2

- ARM3

- ARM4

ARM2 R3 was developed using a Neural Network, and is capable of signal accuracies of 65% - 70%

ARM2 Release 4 uses a new pattern recognition concept called Valid Trend Lines, producing sharp trades at key reversals. Accuracies produced are typically in the 70% to 75% range.

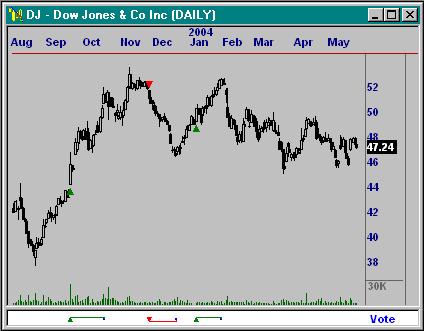

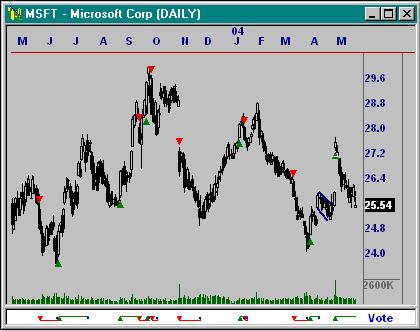

ARM3 is an improved version of our original ARM2 technology. This chart shows the Neural Network in action on Microsoft.

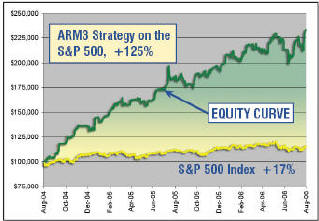

This equity curve reflects the 2 year trading performance of a Genetic Algorithm, called GA-41. Using the same amount of leverage (margin) the Knowledge Base beat the S&P 500 Index by 5 to 1.

Overview - What is "ARM?"

ARM stands for Adaptive Reasoning Model. In the Nirvana Club, we have taken ARM several levels above OmniTrader through the use of applied Artificial Intelligence.

The History of ARM2

ARM2 Release 2 was our first version of ARM Technology delivered to Club members, and was based on a Genetic Algorithm process home brewed here at Nirvana. ARM2 R2 was tunable by the user in terms of desired signal accuracy vs. signal count - a major advancement.ARM2 Release 3 used a Neural Network to determine a positive or negative score at any bar in a chart. The network in ARM2 R3 determines a "likely up" or "likely down" state for the chart at any bar. This gave us a new capability, since ARM2 R3 can be applied to ANY trading signal. ARM2 R3 was released in 2000.In 2002 and 2003, we began experimenting with pattern recognition concepts. ARM2 R4 is based on these findings, which are an application of J.M. Hurst's work on Valid Trend Lines. The proprietary Nirvana Club VTL-B System is still being used to improve performance in ARM3.

ARM3 - The Next Generation

The version of ARM Technology, called ARM3, was literally 'heads and shoulders' above the prior versions. Using recent advances in Artificial Intelligence and taking advantage of the faster processors available today, we re-built our Neural Network and Genetic Algorithm components from the ground up.Members can now build their own Knowledge Bases quickly and easily by simply training our Networks or GAs on their own symbol lists. Or, they can create their own networks using knowledge they have about Technical Analysis. And, in 2006, we improved the Genetic Algorithm component further.

The Move to Equity Curves

Before 2007, we had been using a signal measurement technique called Next Pivot Points, to measure Signal Accuracy. This method told us whether the Entry Signals on a Strategy were improved, but did not yield strategies which could be "mechanically" traded because there were no actual Exits.All that changed in 2006. Our Artificial Intelligence technology is now powerful enough to apply real exits to our strategies - producing Strategies that can be traded mechanically.Our focus now is on improving performance in the Equity Curves until we have reached our Ultimate Trading Machine goal (see About The Nirvana Club). However, since we are delivering Strategies to Members that show mechanical profitability over long periods of time, many members are engaging the market with these products now.

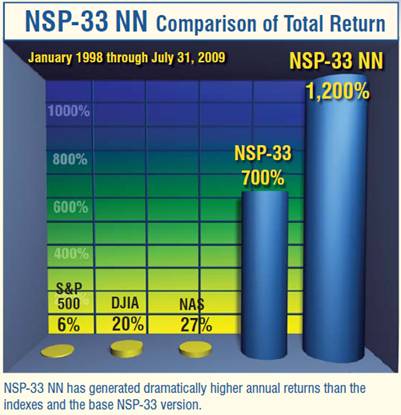

NSP-33 NN

In 2008, we launched a new mechanical strategy called NSP-33. This strategy showed the ability to generate an average return of 20% per year from 1998 through July 2009. Bull Market or Bear Market – this amazing strategy has consistently pumped out profits year after year. After the Strategy was delivered to the Nirvana Club, we applied our ARM3 Neural Network to it to create NSP-33 NN. The result was another immediate performance improvement. By August 2009, NSP-33 NN was up an incredible 38%.

ARM4

A Breakthrough in Artificial Intelligence for Traders

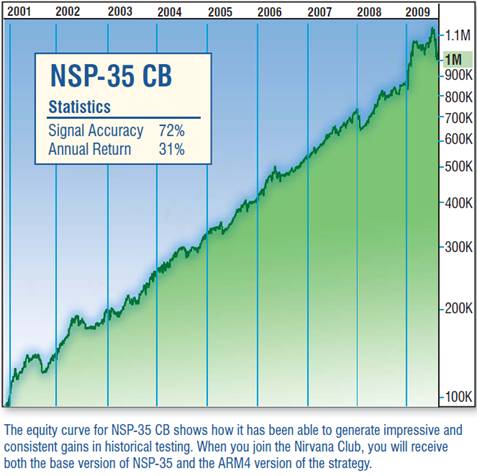

In 2009, we pushed the envelope ahead again, with the new Consensus Block. This new A.I. tool makes it possible to measure the predictive power of any list of formulas or indicators. This is very important, because we are able to eliminate the ones that don’t work well and focus on those that do. When we began this research, we were hoping to build a tool to assist us in this task. What we ended up with was so powerful, we increased our ARM technology to ARM4.The first Strategy to be developed with ARM4 is NSP-35 CB (Consensus Block). It is based on a careful selection of indicator formulas that identify the best trading situations. The Consensus Block identifies those ranges that are most predictive, and then it combines them into a “consensus vote”. The power of this approach is evident in the NSP-35 CB Equity Curve, showing over 30% annual profit from 2001 through 2009.

In 2010, we added Data Mining to our Neural Network process, which dramatically improved performance. In some cases we are seeing the profi ts DOUBLE in our best Strategies!

We are using our ARM technology to empower traders to achieve a superior return. As we do this, we will continue to build new Strategies with tor ARM technology. With the performance gains we are currently seeing, this could easily be the year that we hit our Ultimate Trading Machine goals.

- About ARM2 R3

- ARM2 R3 Charts

- About ARM2 R4

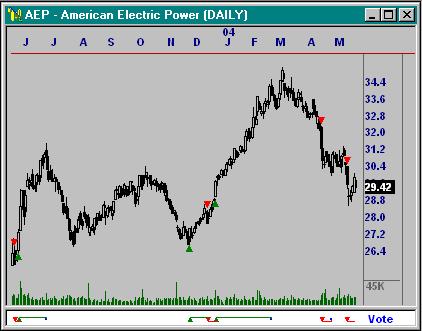

In this chart, you can see multiple ARM2 signals firing in the direction of trend.

ARM2 worked extremely well on stocks that exhibit smooth changes in trend.

Note: ARM2 is no longer used by members (since ARM3 is more accurate), but we have preserved it on our Nirvana Club web site for members to download and experiment with, at their option.

About ARM2 R3

ARM2 was designed around the concept of relating Market Factors (such as the current retracement percentage for a move) with Clues (e.g., volume increasing) to predict the accuracy of a given Signal using Artificial Intelligence methods.

After launching the Nirvana Club in 1996, we built a Genetic Algorithm to find combinations of Factors and Clues that formed "rules" in a Knowedge Base, such as "If MACD is rising and Volume is increasing and today's Open is above yesterday's Close, there is a 70% chance of the security going up."

This process involved many thousands of processing hours. We networked all our machines together and let them "cook" each night to find these rules.

In 1998 we released the first Knowledge Bases to members, calling it ARM2 Release 2 (Release 1 was experimental). ARM2 R2 improved accuracy by about 10 points. That was a great start, but we had a way to go. So we continued looking for better ways to do the same job.

ARM2 R3 - Our First Neural Network

In 1999 we released ARM2 R3 using a commercial Neural Network. We discovered that Neural Networks are better suited to our problem (though we later re-invented the Genetic Algorithm component when we created ARM3.) Market Factors and Clues were fed as "inputs" into a the Nerual Network to find relationships in the data.At each Signal event, a Neural Network was consulted to determine the likelihood of the security rising or falling based on the trained Neural Network. The Network issued a "Thumbs Up" or "Thumbs Down" indication on each Signal. Signals were then either passed to the Vote Line or not based on this determination.The ARM2 Release 3 Neural Networks increased the accuracy of OmniTrader's buy/sell signals by 10 to 20%. An OmniTrader profile that generated an average Forward Test accuracy of 55% could generate accuracies on the order of 65 to 70 percent. This was a phenomenal achievement so early in the Club's life.

How is ARM2 different?

An important aspect of all ARM2 (and ARM3) strategies is the fact that optimization is not used. Standard OmniTrader profiles (like Default) work by optimizing every Symbol individually to find the best parameters for the Systems being used. This is a good way to tune a System, but has the disadvantage that as soon as a new Back Test is run, the Signals will change as new parameters are chosen.

With ARM2 and ARM3, System Parameters are fixed and do not vary, which in turn means the signals will not change. Signals that are passed to the Neural Network either "make it" to the Vote Line or filtered out the same way regardless of how when the Back Test is run. The same Signal will always be seen in the Chart. This behavior definitely makes it easier to "trust" the Signals in real trading.

The Next Generation ARM2

This was very important in our understanding of how to apply Artificial Intelligence technology to the market problem. Using this knowledge, we developed the next generation of A.I. tools for members that takes advantage of OmniTrader's Strategy Builder paradigm - ARM3. ARM3 is our current Nirvana Club Signal Technology. Click here to learn more about ARM3.

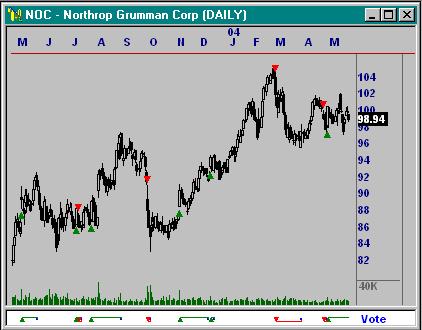

ARM2 R3 Charts

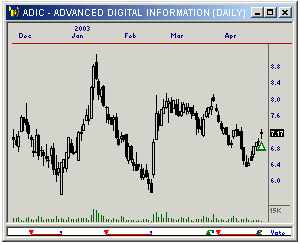

The Charts on this page were generated by ARM2 Release 3. We have replaced ARM2 with ARM3 in our work for the Nirvana Club. These charts were captured shortly after ARM2 Release 3 was delivered to members (May 2003.) More recent charts are available in the ARM3 section.

ARM2 did a great job of firing signals at key reversal points. You can see the excellent Short signals in December and January in this example of ADIC.

Another stock, Aeroflex with ARM2 signals firing at excellent opportunity points to go Long and Short in the first four months of 2003.

ATMI generated more signals at key opportunity points.

Here, we see ATML forming a saucer bottom in March and April (and firing a Long at the right side of the chart). Again, note the powerful Short opportunity identified in early December of '02.

AVID Technology had several nice swings in the January through March timeframe, before the outstanding Long signal which was generated in mid-March.

Beasley tends to move in nice runs once it gets going.

Here we see a number of reasonable entry points on Benchmark (however, we would probably avoid this stock due to its extreme volatility).

Biosite is a very nice trading stock, due to the smooth moves it tends to exhibit. Here you can see a great Long in December, followed by a waterfall Short in late January 2003 - all ARM2 Release 3 signals.

Continental is another smooth mover. We had some very nice opportunities to make money on this low-priced stock in late December and mid January, before volatility increased in March.

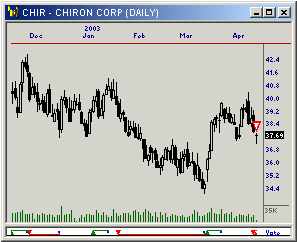

Right away, we see the fabulous Long generated on Chiron in early March (following a nice Short from mid-January).

More great signals on Chattem.

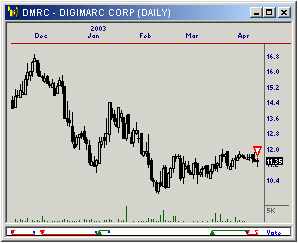

Digimarc had several nice swings from December to March.

Dionex Corporation is a volatile stock that we would probably not trade. However, a we did see a VERY profitable Long generated in January 2003.

We picked up a nice, long trend in Drugstore.com from February, after a shorter, but very profitable Long in late December.

EDS had a waterfall decline in January, which ARM2 alerted us to. It then recovered in a big way in March. Note the ARM2 signal at almost the exact bottom.

These charts were captured shortly after ARM2 Release 3 was delivered to members (May 2003.) More recent charts are available in the ARM3 section.

We see two nice runs in Ford that ARM2 picked up, beginning with the stellar Short in late January 2003 and ending with the equally fabulous Long in April.

Genencor shows two nice ARM2 signals in January 2003 (Long) and February (Short).

Grey Wolf is another volatile stock, but we did see some nice ARM2 signals generated on it.

IDEC Pharmaceuticals had a great Short signals in late January 2003, after an exhaustion gap.

IONA Technologies is a smooth moving stock, even through it was trading around $1.00.

IMPAX Labs had two nice Longs, one in January 2003 and the next in March.

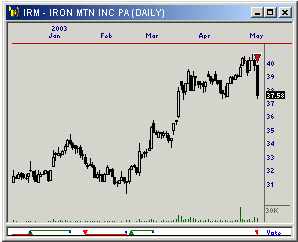

Iron Mountain had several swings in the beginning of the year, all of which were identified by ARM2 R3.

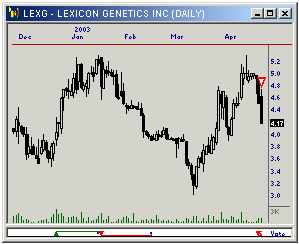

Lexicon Genetics had several nice moves. The Long in mid December 2002 was particularly potent. Note this stock declining in February while the previous stock (IRM) increasing in the same time period. We saw ARM2 R3 signals fire on both, in the correct directions.

This is one of the powerful things about our ARM technology - it allows us to diversify across multiple stocks by trading ARM Signals in both directions.

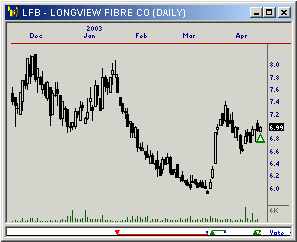

Longview generated an interesting, smooth chart after the Sell signal in mid January, leading up to the Buy in mid March 2003. Because this stock is so low priced, both signals generated huge returns.

Three nice Shorts on Moore Ltd., with a new Long on the right side of the chart.

Newpark is another volatile stock, but we had a relatively clean Long signal generated at the lows in February 2003.

Nextel is a beautiful trading range stock. Note the swings, up and down, beginning January 2003. Each was properly identified by ARM2 Release 3.

We see a near perfect V-bottom signal on ONYX Pharmaceuticals in early February 2003, following two clear Short opportunities.

Here are additional examples of ARM2 Release 3 charts. These charts were captured shortly after ARM2 Release 3 was delivered to members (May 2003.) More recent charts are available in the ARM3 section.

Here we see some interesting patterns on Pharmacopeia. ARM2 caught the 20% run in early March 2003.

American Italian Pasta had several nice Longs in the move up from 36 in early 2003.

PMI Group had several nice Shorts in the decline from a $33 high.

Transocean is a fairly volatile stock, but we did see a few clean signals fire on it - particularly the Shorts in January and March.

Symbol Technologies gave us two nice Short opportunities, one in mid January and the next in early March 2003.

Here, we see some fabulous signals on Sungard.

ARM2 generated some very nice signals on SEI Investments in early 2003.

On some charts, ARM2 only fires a few signals, as was the case on SWS. The good news is, they occurred right at the bottoms.

Syntel is a volatile stock, but we did see some nice signals early in 2003.

Take-two did just that as it dropped form its December 02 high, signaled by ARM2. We also caught the rebound in early March.

UST Inc. has several nice, smooth signals. However, after the stock became volatile in early March 2003 it would have been best to avoid. There are 10,000 stocks to choose from - find another one!

Three picture-perfect signals on Watchguard Technologies.

Valid Trend Lines are essentially sloping support and resistance lines, as shown here on AGN.

Here, we see Valid Trend Lines forming across swings in AIG.

Citigroup shows shorter swings, with good lines.

About ARM2 R4

ARM2 Release 4 is based on ARM2 Release 3, with the addition of Valid Trend Lines (VTLs) to boost accuracy and performance. This technique provided a SUBSTANTIAL boost in performance.

What is a Valid Trend Line?

Valid Trend Lines are essentially tight lines drawn across price action, with specific factors measured to create the best possible lines, such as correlation, angle of line, break bars for the line, and so on.

To the right, you can see a few examples of this method. Valid Trend Lines essentially form sloping support/resistance lines that are very powerful.

When a strong line is violated, the odds of a move following the break are higher, leading to some of the most highly confirmed reversal signals possible.

Using Valid Trend Lines to confirm ARM2 signals

The Valid Trend Line system is a powerful "confirmer." When used in conjunction with ARM2, it helps to isolate those signals which are firing at key reversal points and have additional, favorable characteristics - resulting in greatly increased accuracy, as described below.

Valid Trend Lines can be added to just about any reversal (swing) strategy to improve it. Many Nirvana Club embers are experimenting with various hybrid concepts, and posting great results to the Nirvana Club Forums daily.

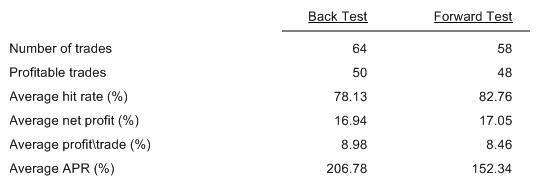

ARM2 Release 4 Accuracy *

With the introduction of ARM2 Release 4, Club Members were able to establish the accuracy they want to see in their signals for the first time.

Valid Trend Lines have a setting called "Correlation". This setting defines how well the lines fit the data in the chart. By simply cranking up the value of this setting, you can get more and more accurate signals out of ARM2. This was an important advancement that led to the creation of ARM3.

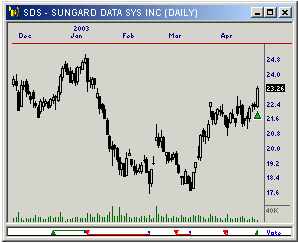

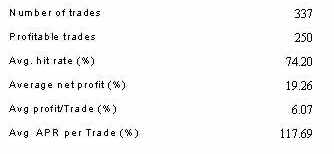

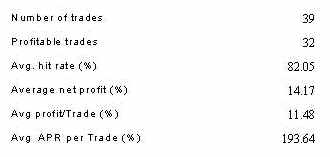

Here are some performance reports from ARM2 confirmed with Valid Trend Lines, on the S&P 100 over 500 bars. It is important to note here that ARM2 profiles are not optimized - you will get the same Signals whether you look at Forward Test or Back Test results. ARM2 Release 4 Signals were typically 70%-80% accurate. *

S&P 100

Accuracy = 74% * correlation at .90 ▼

Accuracy = 82% * correlation at .99 ▼

Tuning Performance

You can see from these performance numbers that, as accuracy increased from 74% to 82%, profit per trade doubled. However, the number of trades decreased to 1/10 the initial value. Some users will want more signals. For them, the former setting is preferable. Others will want the highest accuracy possible, and run thousands of symbols through the system. For them, the latter setting is preferable.

ARM3 Evolution

ARM2 R4 was released in 2003. In 2004, we wanted to increase signal count while maintaining accuracy. This was achieved by creating multiple Knowledge Bases and Neural Networks that are tuned to specific indicators and systems.

ARM3 improved on the ARM2 Release 4 concept by making available the Neural Network Scores and a "cutoff" setting. Users can do the same kind of performance turning with ARM3 that they did in ARM2 Release 4, by adjusting the cutoff setting in the Strategy. See ARM3 for complete information.

* We measured accuracy differently for ARM2 than ARM3. For a detailed description of how we measured the accuracy of ARM2, please see How Accuracy is Measured.

- About ARM3

- NN Score

- ga signal

- ARM3 Signals

About ARM3

What is ARM3?

We have seen many technological advances since ARM2 was created in 1996-98. Computers dramatically increased in both speed and memory. With the introduction of Trade Plans in OmniTrader 2004, we were able to create strategies from building blocks. We rewrote our A.I. engine, creating components which are collectively called "ARM3."

Two Powerful New Technologies Make it Happen.

NN Score

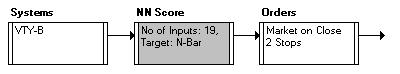

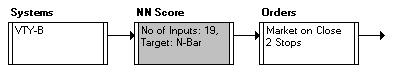

The new NN Score component uses a Neural Network to score signals from any system or vote combination, essentially replacing the Advisor Rating. The PRIMARY input to the NN Score component is a Signal Line within an OmniTrader Strategy - that is, a line populated with trading signals. The SECONDARY inputs, which are used for training, can be any trading system(s) and any indicator or difference between indicator or price values, such as Close(Today) - Close(Yesterday).

The component takes the inputs at points the given Signals occur, and creates a Neural Network to optimize a given target, such as "Profit 5 bars in the future." A Score is generated based on "fitness" of the inputs to the given target. Within the component, the Score can be set to a threshold, so that only the best signals are sent on to the next step in the Strategy (typically Orders, as shown above).

Click here for more information on NN Score.

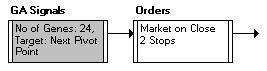

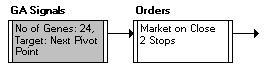

GA Signals

GA Signals is similar to NN Score, in that it uses internal inputs defined from technical measurements and trading systems. However, GA Signals does not score an existing signal line - it CREATES signals from the inputs. GA Signals is useful in situations where you are not sure which system to use to generate a signal, but have an idea that several systems and measurements, when combined, could create a good entry.

That is, by combining 3 Systems and 3 Indicators (for example), some combination thereof would generate a signal - you just don't know what that combination is. GA Signals iterates on the problem space using a Genetic Algorithm process, until it has converged on numerous "rules" which are then added to a Knowledge Base, such as "Long Signal when MAC-M fires a signal and Volatility is between 2.5 and 3.5 and Close is more than 5% above the 21 period Moving Average."

Click here for more information on GA Signal.

Advantages of the new technology:

1. Much higher accuracy and profitability. We are seeing Networks and Knowledge Bases with over 80% accuracy and high profit-per-trade numbers. We have also generated several mechanical strategies which use mechanical exits, creating 100% mechanical systems.

2. Improve the Scores and Performance of any existing system. If you have a system you really like in OmniTrader, the NN Score component is likely to make it better. By using the "canned" settings in the component, you can turn it loose in a strategy on virtually any system and get higher Hit Rastes and APRs from the same system.

3. Users can Train or Re-Train Networks and Knowledge Bases. If you have a list of stocks or futures you would like to "tune" ARM3 to, just activate the ToDo List and specify "ReTrain" in a profile that has ARM3 Strategies. The Knowledge Bases or Networks will be retrained on YOUR data.

4. Members can experiment with their own theories. It takes minutes to define the measurements and inputs for a Neural Network or Genetic Algorithm Knowledge Base inside the NN Score or GA Signals components. If you have an idea about a combination of systems and measurements (indicators) that you believe would predict the market well together, set up an experiment, build a Knowledge Base and test it out. You have the power.

Our advanced ARM technology is a part of a total approach to winning in the markets. If you review the testimonials, you will see that we strive to provide education so that our Club members are empowered to the greatest extent possible, through seminars, articles, and other media. In addition, members may interact with each other to share ideas, trading systems and strategies, adding even more value.

NN Score

The PRIMARY input to the NN Score component is a signal line within an OmniTrader Strategy - that is, a line populated with trading signals. The SECONDARY inputs, which are used for training, can be any trading system(s) and any indicator or difference between indicator or price values, such as Close (Today) - Close (Yesterday).

The component takes the inputs at points the given signals occur, and creates a Neural Network to optimize a given target, such as "Profit 5 bars in the future." A Score is generated based on "fitness" of the inputs to the given target. Within the component, the Score can be set to a threshold, so that only the best signals are sent on to the next step in the Strategy.

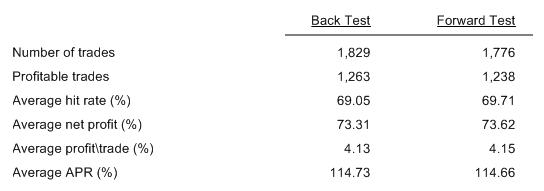

Here are some statistics on the Volatility Breakout System, before using the Neural Network enhancement, and after. You will see that the overall hit rate for the profile went fro 69% to 82%, and many unprofitable signals have been eliminated.

Virtually any system in OmniTrader can be improved the same way. We are using NN Score to boost the performance of ARM3. Clearly, we are very excited about this new technology!

Performance Reports (S&P 100)

BEFORE using the Neural Network

AFTER using the Neural Network

Charts from the Profile (Before and After)

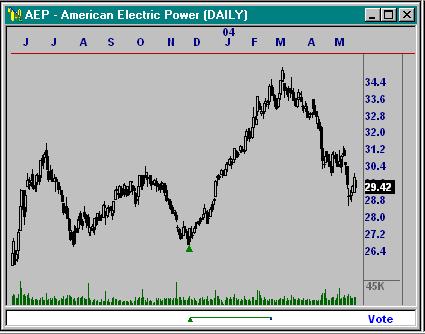

Before using the Neural Network

AFTER using the Neural Network

Before using the Neural Network

AFTER using the Neural Network

Before using the Neural Network

AFTER using the Neural Network

Before using the Neural Network

AFTER using the Neural Network

Before using the Neural Network

AFTER using the Neural Network

Before using the Neural Network

AFTER using the Neural Network

Before using the Neural Network

AFTER using the Neural Network

NN Score improves virtually any trading system to generate fewer, better Signals!

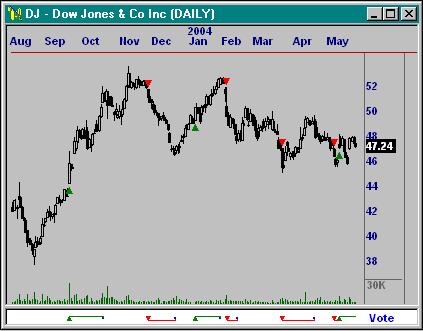

GA Signals

GA Signals is useful in situations where you are not sure which system to use to generate a signal, but have an idea that several systems and measurements, when combined, could create a good entry. That is, by combining 3 Systems and 3 Indicators (for example), some combination thereof would generate a signal - you just don't know what that combination is.

GA Signals iterates on the problem space using a Genetic Algorithm process, until it has converged on numerous "rules" which are then added to a Knowledge Base, such as "Long Signal when MAC-M fires a signal and Volatility is between 2.5 and 3.5 and Close is more than 5% above the 21 period Moving Average."

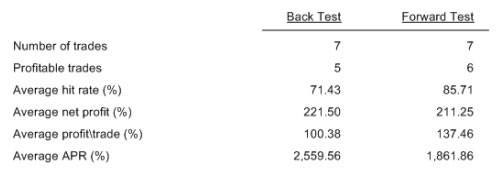

Test case #1: Futures Knowledge Base on Currencies

We generated a Knowledge Base by using continuous contracts on currencies going back 30 years (that is, our Back Test for training was set to use all 30 years of data). We reserved a one-year Forward Test at the end of training as an "out of sample" test period:

Currencies Used:

EuroDollar

British Pound

Australian Dollar

Canadian Dollar

American Dollar

Japanese Yen

Swiss Franc

After training, we changed the Back Test to one year so we could compare similar time frames (one year Back Test and one year Forward Test). The resulting performance report is shown here:

Here is a chart for the Swiss Franc:

Test Case #2: Knowledge Base for Grains

Here is a chart for Wheat:

This page shows an example of the ARM3 Signals page (for 9/23/2008). New ARM3 signals are posted to the Nirvana Club member web site each day. Members can access the site from anywhere in the world to review the opportunities presented by ARM3. Chart patterns which confirm the ARM3 signals are listed to the right of the signal. The charts also show historical signals generated by ARM3.

Breakthrough in ArtificialIntelligence for Traders

ARM3 is based on the concept of measuring technical inputs and feeding them into a Neural Network to find profitable relationships. This process has yielded some of our best strategies, including NSP-33 NN. However, one of the challenges in building these strategies has always been, “How do we identify the best inputs to use?” This year, we set about answering this question.

The Consensus Block represents a major advancement in technical analysis. It’s the perfect marriage of artificial and human intelligence, providing detailed insight into how different indicators and events help to predict future market behavior.

The Consensus Block performs two separate jobs, the first of which is called “Data Mining.” For this step, we define a list of indicators and formulas that we think might be predictive. Then we enter them in the Consensus Block and let it measure them across a large symbol list and years of data.

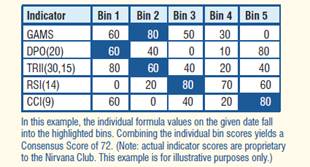

The result is a table that indicates the predictability of each input (see example) for different ranges of the input. In the second step, the Consensus Block combines the given inputs using a Genetic Algorithm, resulting in a score from 0 to 100. We only trade those signals with the highest scores.

With the Consensus Block, we can now greatly accelerate our development of profitable trading strategies. The fi rst is NSP-35 CB (discussed next).

Using the Consensus Block

In the example to the right, we are using 5 indicators. Values of the GAMS Oscillator range from -4 to +4. The Consensus Block divides this range into 5 equal parts called “Bins.” It then measures the profi tability of GAMS in each of these ranges to determine a score for the corresponding bin. Later, during the Signal Generation process, the Consensus Block combines bin scores to generate a Consensus Score.

The “Rocket Science” (How it Works)

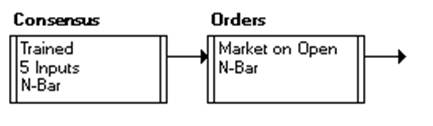

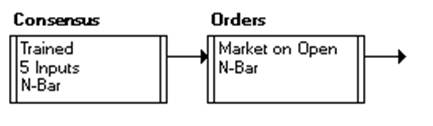

The following example demonstrates how the various features of the Consensus block can be used to gain knowledge into predictive measurements and create a trading strategy. As previously discussed, several configurations are possible. In order to prove the concept, we will employ the simplest configuration that consists in a strategy with only two blocks.

Simple Consensus Strategy flowchart

Step 1: Data Mining

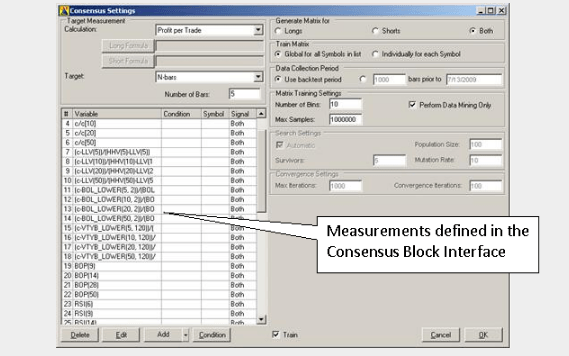

First, we select a comprehensive number of measurements that - we think - may characterize the behavior of the symbols in our list. For the present example, we are using the SP100 in the daily timeframe. The following dialog box shows some of the variables that were selected. Note how some measurement formulas are repeated with different parameter values, usually the Period parameter in order to see whether a slower or a faster indicator is more predictive. For sake of simplicity, no conditions were specified in this example.

In the Consensus Block, we define the measurements (indicators) we will test.

Measurements can be technical indicators, variations on price or combinations.

A total of 51 variables were specified in this Consensus block. In order to reduce the number of variables to a smaller set of effective measurements, we will start by performing a Data Mining run (with Perform Data Mining Only checked in the dialog box). In addition, because we intend to collect data at every bar for several years (from 2001 to 2006) and over about 100 symbols, we increase the Max Samples setting to 1,000,000, thus ensuring that all collected data samples are represented in the statistical results. The Data Mining run can now be initiated. For a large experiment such as the one described, this run can take several hours, depending on the computer system's specifications.

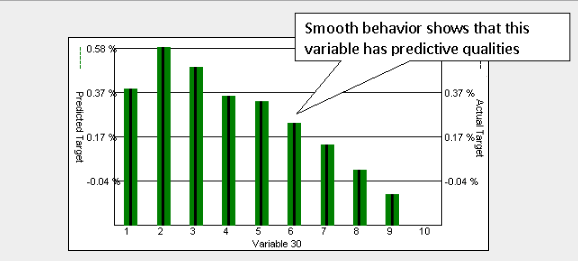

When the run is completed, we access the Data Mining and Matrix Analysis interface in order to identify the measurements that showed a significant correlation with the recorded target. The next figure, taken from the Consensus Block Analysis screen, depicts the relationship between CCI(9) and the average target value. With the exception of Bin(1), a well-defined decreasing function is clearly visible. After reviewing quartile and standard deviation measurements in the statistics table, we can safely say that – for this particular setup – CCI(9) has predictive value.

Target Sensitivity plot for CCI(9).

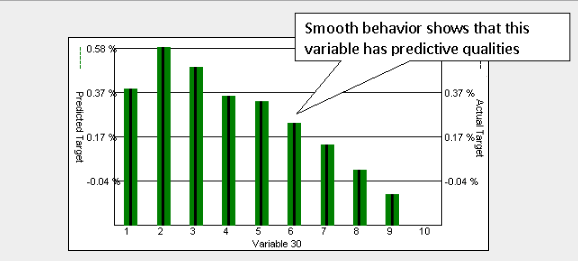

However, the next view shows Close / Close ten bars ago (C / C[10]) without significant correlation. This variable can be deleted from the strategy to simplify the configuration in preparation for a full training session.

Target Sensitivity plot for C / C[10].

After repeating this analysis for all variables, we selected the smallest number that exhibit the best correlation with the targets:

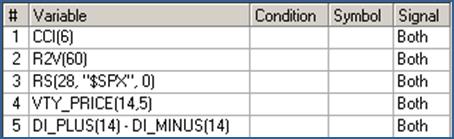

Figure 15. Final Formulas chosen from Consensus Run

Step 2: Evaluating the Results

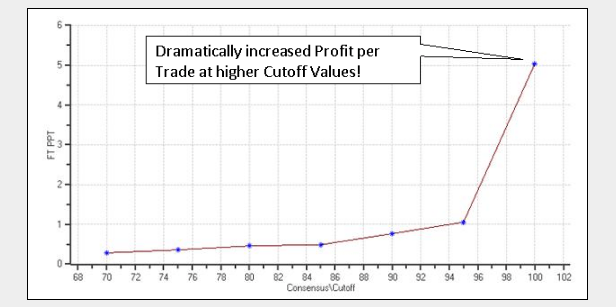

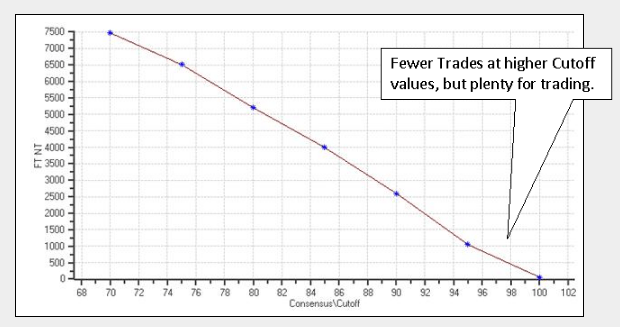

After we identify the indivators and other formulas we want to use for trading, we train again on ONLY those values, allowing the Consensus Block to combine individual values to produce a Consensus Score after it finishes its Data Mining Step. Consensus Scores vary from 60 to 100. By increasing the Consensus Cutoff and running profitability tests on the resulting signals, we see a DEFINITE RELATIONSHIP between CONSENSUS SCORES and PROFITS.The following diagrams depict the number of trades and average profit per trade results obtained by varying the Consensus Cutoff (Filter) value, the back-test is the same period used for data mining runs, while the forward-test is the remaining data up to July 7th, 2009. You can see from the graph that the profit per trade increases while the number of trades decreases at higher cutoff values, confirming that the chosen variables can indeed produce valuable predictions for the 5-bar price movement.

Figure 18. Forward-test Profit per Trade vs Consensus Cutoff

This plot not only proves that the Consensus Block “works” – it shows greatly increased profits at high Cutoff Values. The next plot shows the expected relationship between Cutoff Values and Trade Count – the higher the Cutoff, the fewer trades “pass” to the Vote Line. But, the great thing about the Consensus Block is, even at high Cutoff levels (like 96) there are still a very large number of trades.

Number of Trades in the Forward Test vs. Consensus Cutoff Value

Full Statistics for different Consensus Cutoff values.

Step 3: Trading with the Results

The next screen shot shows how the consensus block in this strategy was able to identify the bottom of General Dynamics Corp on 3/9/2009 (in the forward-test period) by combining the predictions obtained by each of the indicators displayed in the chart. Trades like this are common in the output of the new NSP-35 CB Strategy, to be released to the Nirvana Club in the Fall of 2009.

A Consensus Block trade on General Dynamics Corp.

The chartincluding plots for the indicators used by the Consensus Block.

In 2010, we added Data Mining to our Neural Network process, which dramatically improved performance. In some cases we are seeing the profi ts DOUBLE in our best Strategies!

Millions have been invested in the development of ARM4, which is by far the most powerful Artifi cial Intelligence technology ever created for traders. As a result of recent advances, we are now seeing 80% Hit Rates in many of our Strategies— the fi rst performance goal for The Ultimate Trading Machine.