ATM Methods are pre-configured to provide you with superior performance in any type of market. Click on the download link for each method to download and install them into your OmniTrader. New ATM methods are under development, so be sure to check this page often for new releases!

ATM Universal Method

Released January 5, 2018

The Universal Method uses several Trading Strategies in different Market States in order to outperform bull markets and excel in bear markets.

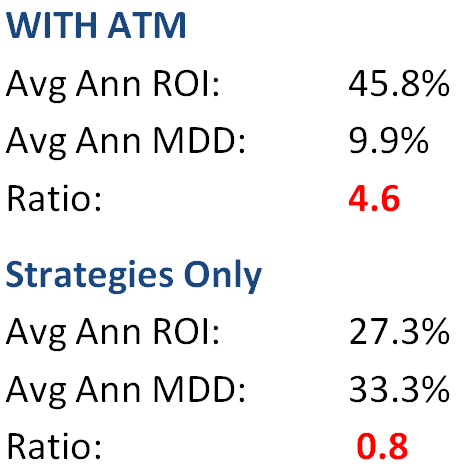

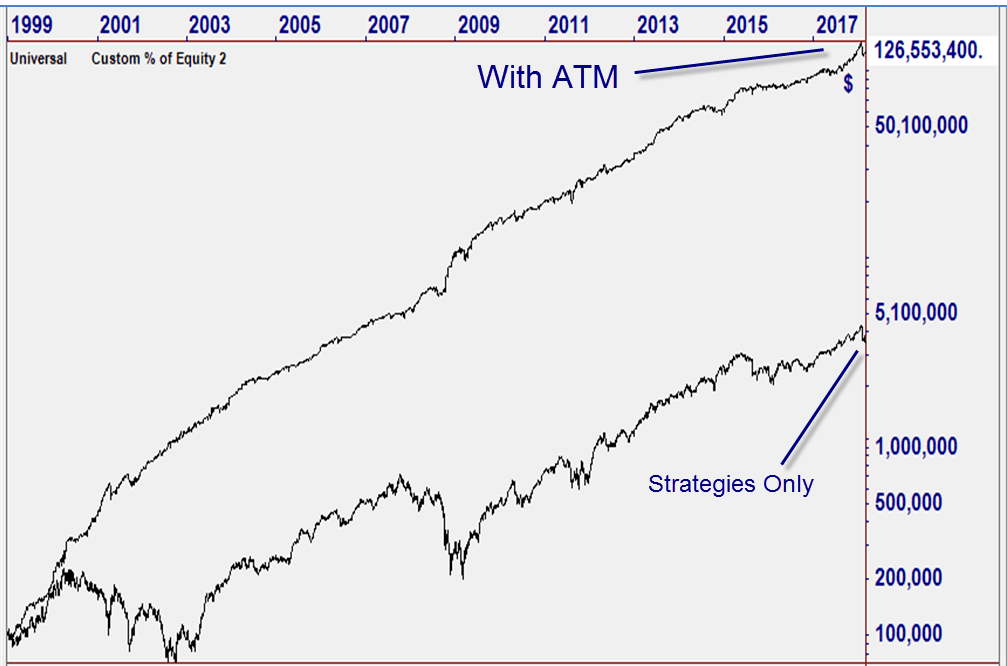

The equity curve to the right compares performance between using ATM and not using ATM (Strategies only).

The same Strategies were used, but the ATM curve uses Market States, Ranking, Long-Short Balancing and Allocation on the trades from the Strategies.

These tests used the same strategies and the same per-trade allocation. The difference is in the Ranking and Market States used to select the best trades, and establish Long/Short balancing in the direction of the market.

The difference in performance is significant. Ending equity reached about $4m for Strategies Only, vs. $127m using ATM. Note that a LOG scale was used. If a linear scale were used instead, the "Strategies Only" curve would appear as a flat line at the bottom of the chart. All screen shots on this page use LOG scales.

ATM ARM5 Method

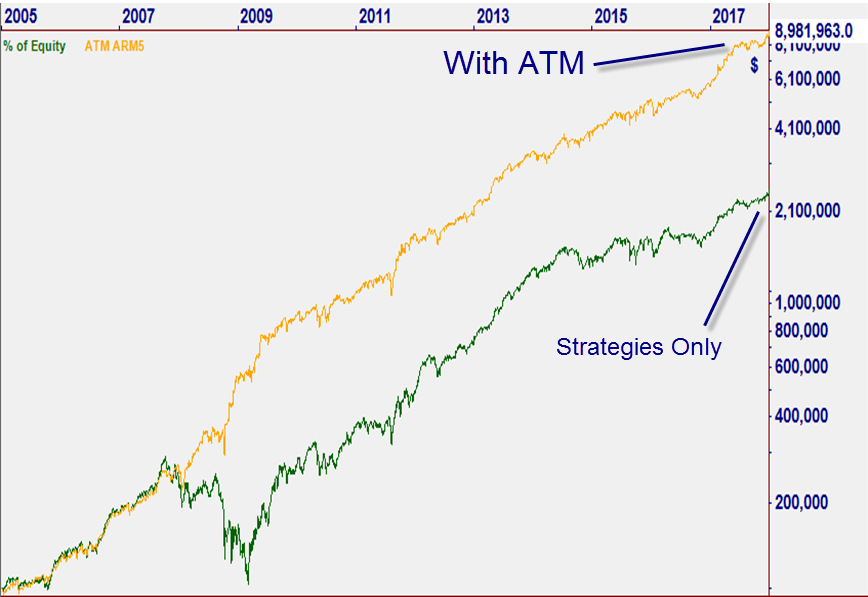

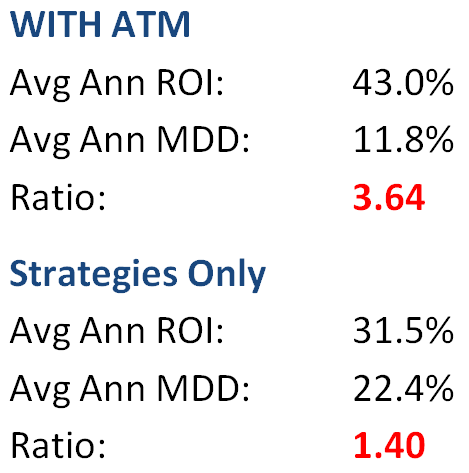

This recent view of select ARM5 Strategies with ATM versus ARM5 running by itself shows a dramatic improvement in performance. Draw downs are reduced to 1/2 what they are in the original Strategies. (Note: This test was run from 2005 to make it easier to see the more recent performance.)

Released February 6, 2018

The ATM ARM5 Method leverages the power of the Nirvana Club’s ARM5 Strategies and couples it with control provided by ATM in order to generate consistent returns.

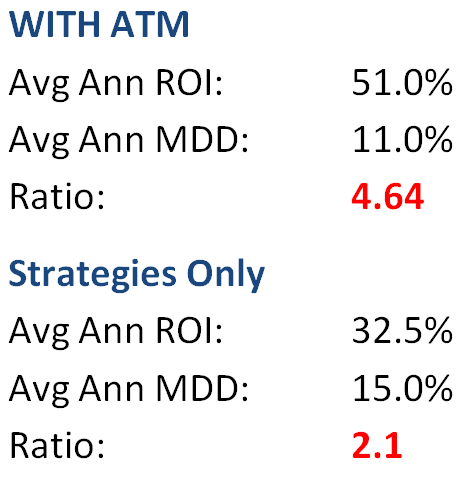

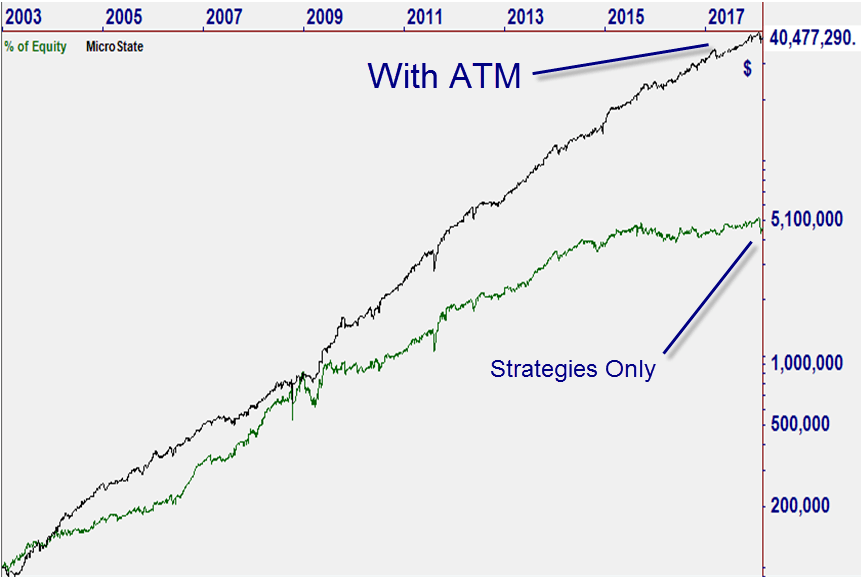

ATM Micro States Method

Released March 1, 2018

The Micro State Method was created by Nirvana customer Mark Holstius. This method uses Market States based on short term market direction - obviously a winning formula.

The new Micro States method shows very high profitability, compared to the same Strategies used without the assets of ATM applied. Notice the smooth curve and low draw downs inherent in the method. (Note: This test was run from 2003 to make it easier to see the more recent performance.)

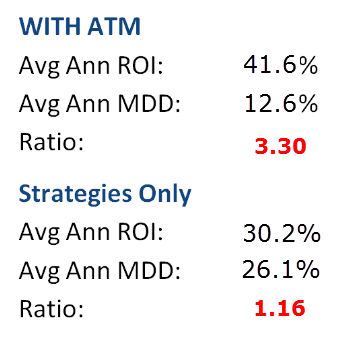

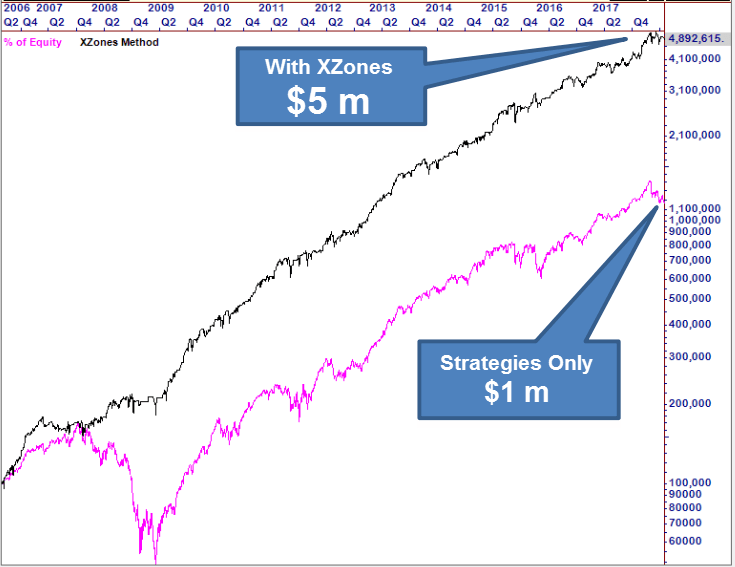

XZones Method

Released June 20, 2018

The XZones Method was created by Jeff Drake. This method uses our best Reversion to Mean Strategies in combination, under Market State Control.

Required: X-Suite, XLS-19 V2, Z3, and iZones. Call Nirvana Sales at 800-880-0338 for an ATM Owner Discount on these Strategies if you do not already own them.

The new XZones method shows solid profitability, compared to the Strategies the ATM Method applied. (Note: This test was run from 2006.)

Important Information:

Futures, options and securities trading has risk of loss and may not be suitable for all persons. No Strategy can guarantee profits or freedom from loss. Past results are not necessarily indicative of future results. These results are based on simulated or hypothetical performance results that have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. There are numerous market factors, including liquidity, which cannot be fully accounted for in the preparation of hypothetical performance results all of which can adversely affect actual trading results. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.