Turtle Trader

$395

Compatible Platform: OmniTrader / VisualTrader

Recommended Data: End Of Day / Real Time

Exact Replicas of Original Turtle Strategies, additional Strategies based on Way of the Turtle, TWO NEW Nirvana Strategies – DOUBLE the Profits with Half the Drawdowns!

Introducing Nirvana's Turtle Strategies

The original Turtle Strategies and those developed later by Curtis Faith used several indicators, including Moving Averages, Bollinger Bands and Donchian Channels to identify breakouts in trend. And the Turtle Strategies have been shown to work extremely well over the long haul.

The Turtle Method

The Turtle Method is similar to the Fulcrum Method taught at SignalWatch.com. The basic idea is to trade solid, definitive breakouts and apply wider stops as the trade becomes more profitable.The original Turtle Strategies used Donchian Channels to identify breakouts. Curtis Faith incorporated other indicators, such as Bollinger Bands, to give his Systems improved accuracy. He also used Moving Averages as trend filters. The profitability of these systems over the past ten years has been excellent, with average annual returns of 29% to 58% from January 1996 through June 2006.

Turtle Trader is Born

With the recent publication of Faith’s new book and the results he published, we decided to develop a plug-in for OmniTrader so our customers could trade like a Turtle and learn from the Turtle Strategies.

Works on Stocks and Futures

The Turtles traded futures exclusively. However, we know most of our customers trade stocks, so we developed and tested TurtleTrader in the stock market—the equity curves on page 9 are based on trading stocks with the Nirvana Turtle Breakout LT Strategy.The same Strategies work in the futures market—just create a futures profile, activate one or more of the TurtleTrader Strategies, and run the To Do List! If you have ever wanted a comprehensive collection of Turtle Strategies, this is it. Remember, our plug-ins are guaranteed! Now is the perfect time to discover “Turtle Power” for yourself.

PROFITABILITY of the Nirvana Turtle Strategies

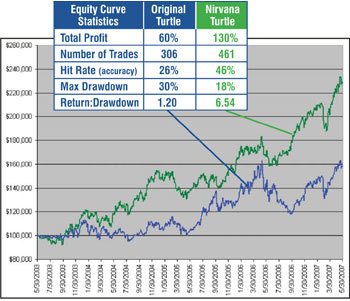

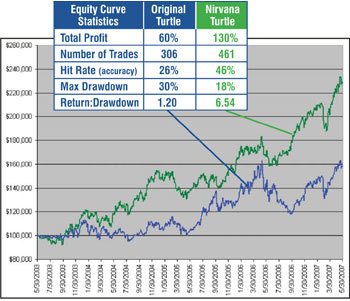

Here is the result of a recent run in the Portfolio Simulator for the Nirvana Turtle Breakout (Long Term) vs. the Turtle Bollinger Breakout System on the stocks in the S&P 100 index.

While the original Strategy was certainly profitable, the Nirvana version generated more than DOUBLE the profits with almost HALF the drawdowns. It is also considerably more accurate. This new and improved Turtle Strategy is included with the TurtleTrader plug-in.

Turtle Donchian Trend – Uses Donchian Channel indicator for breakout entries and a special Turtle Stop.

Turtle Triple Moving Averages – Curtis Faith used Multiple Moving Averages to identify longer term trends, as shown here on these Signals on Campbell Soup.

NEWStrategiesIncluded:

TheOriginalTurtleStrategies

- Original #1 – Trades Donchian Channel breakouts with a profit filter

- Original #2 – Trades develop over a longer period. Uses the Turtle Stop

WayoftheTurtle Strategies

- ATR Channel – Uses ATR Bands to generate entries with an MA Stop

- Bollinger Breakout – Uses Bollinger Band extreme points for breakouts

- Donchian Trend – Similar to Original #1, but with a different trending filter

- Donchian Time – Similar to Donchian Trend. Exits in a fixed amount of time

- Dual Moving Avgs – Always in trade through the use of two Moving Averages

- Triple Moving Avgs – Similar to Dual, with an additional trending Moving Average

NirvanaTurtleStrategies

- Nirvana Breakout MT – Based on Original #1. Applies the Eighths Tool Exit

- Nirvana Breakout LT – Based on 2 Breakout Strategies published in Way of the Turtle